Telstra and Optus: Falling ARPUs, increase in price sensitive market and Enterprise declines

- Chris Blyth

- Jul 8, 2020

- 10 min read

The outlook for the next 1-2 years remains subdued as competitive intensity in both fixed and mobile will put pressure on ARPUs which will in turn means a strong focus on keeping costs under control to maintain profitability.

Whilst Optus and Telstra have increased their subscriber numbers for both fixed and mobile, this hasn’t always translated into revenue growth due to decline in ARPUs. Indeed both Telstra and Optus reported modest declines in their fixed and mobile revenues respectively.

Interestingly, Telstra noted an increased activity in the price sensitive end of the market with strong performance in Belong and Wholesale. Whilst this supports Telstra’s multi brand strategy, it also leads to a decline in ARPU from a higher mix of Belong customers. Telstra Wholesale’s MVNO business achieved 5% rev. growth which confirms our previous growth views for the MVNO market.

5G will be a key battleground for Australian telcos. Our previous consumer survey highlighted a srong early adopter segment for 5G and we still believe that leadership in 5G rollout can still equate to additional subscribers driven by churn from other operators. We believe holding a price premium for 5G will be difficult and subject to how Vodafone prices its 5G services.

Optus and Telstra have recognised that media and gaming are important for their overall bundling strategy. Over the coming years we believe 5G network slicing will bring ARPU gains for use cases such as mobile gaming and sports streaming.

Enterprise revenues have declined driven by increasing price competition as smaller and potentially more innovative competitors emerge and resell NBN. Telstra’s growth in international was offset by a decline in domestic, leading to an overall decline for Enterprise.

Introduction

Telstra and Optus reported earnings on 13th February 2020. While Telstra reported its 1HFY20 earnings, Optus reported its 3QFY20 earnings. In this report, we have analysed some of the key trends observed across the two major telcos and compared these with Venture’s Australian telco market outlook and forecasts.

Telstra 1H20 earnings update

Telstra announced its first half FY20 results on 13th February 2020 with performance roughly in line with expectations and guidance given the challenging market and the margin pressures from the NBN. Telstra’s total income was down 2.8% to $13.4 billion with fixed line services continuing their income decline and mobile slightly ahead due to hardware revenue growth. Telstra’s T22 strategy is well under way, with organisational transformations, cost reduction plans and simplification of product lines having already had an impact on financial performance and customer satisfaction. Despite falling key financial metrics across its income statement, Telstra remains optimistic about its short- and medium-term future, continuing to emphasise the company’s “world-leading” 5G progress and further cost reductions as reasons for future profit growth.

Interestingly, Telstra notes that one of the features of the half year was increased activity in the price sensitive end of the market with strong performance in Belong and Wholesale when compared to Telstra branded. Whilst this supported Telstra’s multi brand strategy it also led to a decline in ARPU from a higher mix of Belong customers.

Key financial metrics are below:

Figure 1. 1HFY20 Telstra key financials (A$m)

SOURCE: TELSTRA 1H20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Note: The numbers in the table are ‘reported basis’, not ‘reported lease adjusted’, where the latter includes all mobile handset leases as operating expenses, and all rent/other leases below EBIDTA.

2. Figure 2. Telstra’s total income by segment

SOURCE: TELSTRA 1H20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Optus 3QFY20 earnings update

On 13th February 2020, Optus announced its 3QFY20 earnings update. Some of the key highlights from the announcement included:

Revenue of A$2,393m, down 1.1% over 3QFY19 with higher NBN migration revenue offsetting lower equipment and service revenues.

The operating expenses for the quarter fell by 3.6% due to a strong focus on cost management.

Operating EBITDA increased by 5.5% to A$700m due to NBN migration revenues. However, excluding NBN migration revenue, EBITDA declined 25% due to increased traffic costs from a higher NBN customer base and lower contributions from Mobile equipment revenues.

Net profit of A$131m, down 24.2% over 3QFY19.

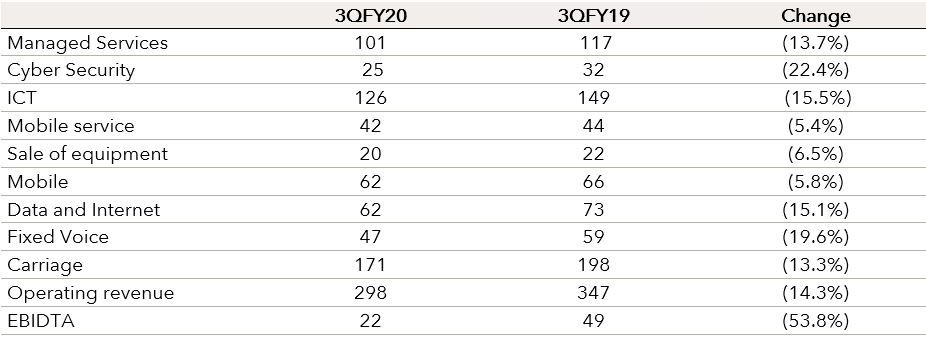

Figure 3. 3QFY20 Optus key financials (A$m)mobile

SOURCE: OPTUS 3QFY20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Mobile

Key highlights:

Total mobile revenues for Optus consumer declined 8.6% due mainly to lower equipment sales, while the decline in service revenue moderated to 3.1%. Increase in mobile prices and introduction of Optus Choice plans to replace bundled mobile plans have resulted in reduced sales volume and price competition. Telstra’s mobile revenue grew slightly by 0.3% with growth in hardware partly offset by postpaid handheld, prepaid handheld and mobile broadband declines of 3.6%, 13.4% and 7.1% respectively.

Optus postpaid ARPU declined 8% and prepaid by 1% due to the increased mix of SIM-only plans and data price competition. Telstra postpaid ARPU also declined by 7.4% due to FY19 competition washing through the base, modest dilution due to an increase in Belong customer mix, and accounting of new plans. Telstra’s prepaid ARPU also declined contributing to a decline of 13.4% in the prepaid handheld revenue. However, Telstra was optimistic that ARPU trends would improve going forward.

Subscriber growth increased as Optus added 57,000 postpaid subscribers QoQ, 157,000 prepaid customers QoQ and 14,000 mobile broadband subscribers QoQ. During the last half, Telstra added 137,000 retail postpaid mobile services (including 91,000 from Belong) and 135,000 retail prepaid mobile services.

Telstra IoT SIOs continued to show strong growth of 23% bringing total SIOs to close to 3.5 million. However, this represents a relatively small revenue base of $102 million (1H20) which translates to 3% revenue growth.Telstra’s wholesale MVNO business achieved 5% revenue growth.

Figure 4. Mobile ARPUs decline

SOURCE: OPTUS 3QFY20 EARNINGS ANNOUNCEMENT AND PRESENTATION, TELSTRA 1H20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Our Take

While subscriber numbers continue to grow steadily driven by churn and population growth, falling APRUs will keep pressure on revenue growth. There is evidence that customers are holding onto their phones for longer and looking for more mid-range devices, which might affect handset revenues. As will be explained in the next section, 5G presents an opportunity for telcos to combat ARPU decline, though it may be some years until the benefits will be realised given that 5G mobile networks are still being rolled out. 5G fixed wireless is also an opportunity to focus on specific customer segments (such as the business market) and also to migrate consumer NBN users to potentially improve margins.

We note that on the same day as the announcement of Telstra’s and Optus’ results, the Federal Court overruled ACCC’s objection to the TPG-Vodafone merger. We believe the court’s decision to allow the TPG-Vodafone merger (if ACCC doesn’t challenge the decision) will be good for both Telstra and Optus as this will reduce the risk of price competition from an aggressive TPG mobile entrant focussed on metro areas.

We note that Telstra Wholesale’s MVNO business also achieved 5% revenue growth which confirms our views that the MVNO market will continue to grow – see our previous report on the Australian MVNO market.

5G and Fixed Wireless

Key highlights:

2019 saw 5G services launched by Telstra and Optus using their existing spectrum holdings[1]. Telstra has switched on 5G services in 32 Australian cities, while Optus has 400+ live 5G fixed wireless sites. Telstra aims to expand to 35 cities by the end of FY20, and Optus aims to expand the number of sites to 1,200 by March 2020.

Incremental pricing of 5G mobile services has effectively been waived to date by both Telstra and Optus. Telstra has reaffirmed its plans to monetise 5G starting at the end of the current financial year. However, we still believe this may be influenced by Vodafone’s 5G entry pricing.

Both Optus and Telstra have recognised that gaming and video will be two important use cases for 5G. See Media section below for more details.Telstra has over 100,000 5G capable devices now connected to its network with around one in four Android mobile handsets sold since July 2019 being 5G compatible.Telstra has plans for trials for mmWave technology in 2020 preparing for the scheduled 2021 auction. It also stated that 2H20 will have an outflow of $386 million for 5G spectrum.The Optus 5G Home Broadband product is priced at A$70 per month and will include unlimited data on a 50Mbps speed. This price point is the same as its fixed NBN product. For more details on 5G pricing by Telstra and Optus, read our report on 5G update in Australia.

Our Take

Telstra has repeated its strategic focus on leading in 5G. Our previous consumer survey highlighted a srong early adopter segment for 5G and we still believe that leadership in 5G rollout will equate to additional subscribers driven by churn from other operators for the early adopter market. We also believe that 5G network slicing will bring ARPU gains for use cases such as mobile gaming and sports streaming. Whilst we are still waiting to see product launches which take advantage of 5G’s network slicing abilities, we believe this may be a focus for both Telstra and Optus in H2 2020.

Over time, we expect to see growth in fixed wireless substitution which in turn will place more pressure on NBN to either cut their wholesale prices and/or increase their service speeds.

Finally, whilst Telstra and Optus have a 5G rollout lead over Vodafone, we expect to see the VHA and TPG merger focus on 5G rollout and their pricing will still have a strong effect on how Telstra and Optus play in this space.

Fixed

For Optus, the retail fixed segment saw revenues increase by 46% impacted by the increase in NBN migration revenues and wholesale fixed revenue increased by 2.5%. For Telstra, fixed revenue declined by 10.9% due to NBN migration, competition and ongoing legacy decline. Telstra’s retail bundles and standalone data revenue declined by 1.8 per cent and standalone voice declined by 28.3% driven by voice line abandonment and migration to bundles.

Optus retail fixed ARPU fell by 4% YoY and its number of NBN customers was up by 77,000 QoQ. Telstra retail bundles and standalone ARPU fell by 4.2% from A$75.90 to A$72.72 due to competition and migration to in-market plans.

In Mass Market Fixed, Optus’ NBN customer base grew by 254,000 customers from a year ago. Telstra has 2,964,000 NBN connections, which is an increase of 359,000 in the half and represents a market share of 47% excluding satellite. Belong now has around 300,000 fixed services.

The Telstra Smart Modem is being utilised by 62% of its fixed consumer base which we believe provides a clear selling differentiation against those RSPs without a ‘mobile backup solution’ to their NBN service offering.

Figure 5. Operating metrics for fixed for Optus and Telstra

SOURCE: OPTUS 3QFY20 EARNINGS ANNOUNCEMENT AND PRESENTATION, TELSTRA 1H20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Note: Optus retail includes small sized businesses, and wholesale includes fleet fixed and medium-sized businesses

Our Take

It is evident that the NBN is affecting the major telcos by eating into their retail margins. Telstra’s earnings estimated the net negative recurring EBITDA impact of NBN on its business to be ~A$360m as of December 2019 and expects the NBN impact to be maximum in FY21. Many RSPs including Telstra have repeatedly highlighted that NBN wholesale pricing is too high and that it is making almost no money as a NBN reseller. Optus’ entry into the 5G fixed wireless market is a clear strategy to utilise its own network for broadband services rather than pay wholesale prices to NBN and Telstra’s focus on smart modems also positions it as a potential fallback to mobile for some NBN customer segments.

With the ACCC inquiry into NBN pricing still underway, it is not clear what impact this will have on RSP margins and whether any margin increase will only apply at the entry level service. Hence we expect continued focus on NBN margins from the RSPs – especially as NBN also pushes into the business segment (see below).

Media

Both Optus and Telstra recognise that media and gaming are important for their overall bundling strategy and differentiation.

Telstra emphasised that media was important including Foxtel, ownership of mobile digital rights and Telstra TV, even though Telstra’s media income declined by 5% in 1HFY20 over 1HFY19 and 94,000 subscribers exited Foxtel over the past one year due to a transition of consumers from Broadcast to IPTV. Telstra’s IPTV income remained stable over the same period, and the number of Telstra TV devices increased by 213,000.

In addition, Telstra’s Sports Live Pass users increased to 3.2m (up by 602,000) over the last year across AFL, NRL, Netball and FFA.

Telstra has also entered the gaming business in partnership with Microsoft that will see it become an exclusive partner for Microsoft’s Xbox All Access gaming package in Australia.

Optus has also placed an emphasis on video and reached an agreement with the Seven Network to broadcast Tokyo 2020 Olympics in 4K Ultra HD to Optus 5G Home customers. Optus Sport has reached 825,000 active subscriber accounts who can enjoy premium football content, including the recently- announced premier Japanese football tournament. Optus considers exclusive content as a core product differentiator.

Figure 6. Telstra income from media (A$m)

SOURCE: TELSTRA 1H20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Enterprise, Data, NAS

Optus Enterprise operating revenue fell 14% and EBITDA declined 54% YoY, impacted by weaker demand from slower economy and increase in competition from new entrants reselling the NBN.

For Optus, Mobile service revenues fell due to stiff competition and Data and Internet revenue fell due to competitive pricing pressures and lower volumes. Fixed voice revenue decreased on steep price erosion, lower call usage and declines in switched voice business as enterprise customers continued to migrate to lower cost IP-based solutions.

Income for Telstra Enterprise decreased by 1.8 per cent to $3,882 million as growth in international was more than offset by a decline in domestic. Telstra Enterprise domestic income decreased by 5.1 per cent due to declines in Data & IP including IP based Virtual Private Network (IPVPN) and Integrated Services Digital Network (ISDN). Telstra Enterprise international income grew by 9.0 per cent mainly due to growth in higher margin Data & IP and a positive impact from the depreciation of the Australian dollar (AUD).

Telstra Data & IP revenue decreased due to legacy product declines especially within ISDN, competitive pricing pressures and technology shifts.

Figure 7. 3QFY20 Optus Enterprise key financials (A$m)

SOURCE: OPTUS 3QFY20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Figure 8. 1H20 Telstra Enterprise revenue breakdown (A$m)

SOURCE: TELSTRA 1H20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Our Take

The enterprise segment which has traditionally been viewed as a safe haven in terms of growth is seeing rising price competition as smaller and potentially more innovative competitors emerge and resell NBN. This has led to declines across this segment, against our previous forecasts of between 2-3% growth.

NBN’s entry into the enterprise segment has raised concerns that the enterprise access business may suffer the same fate as consumer broadband margins – placing a strong focus on efficient RSP costs. However, NBN has taken note of the industry concerns recently and Telsra’s CEO noting that he was “pleased to see NBN recently acknowledge the industry’s view that it should not be contracting directly with end customers as a wholesaler”.

In the next few years, we believe that the expansion of 5G – in particular fixed wireless may bring some growth for the Enterprise market.

Telstra Infraco

Telstra InfraCo is now fully operational as a standalone infrastructure business unit within Telstra. During Investor Day 2019[2], Telstra formally announced that it will transfer most of its passive infrastructure such as data centres and exchanges, most of its fibre network, international subsea cables, towers, poles, ducts and pipes to InfraCo.

Figure 9. Telstra InfraCo Key Assets

SOURCE: TELSTRA 1H20 EARNINGS ANNOUNCEMENT AND PRESENTATION

Although the income from InfraCo declined by 12% to A$1.4b due to expected declines from Telstra Wholesale fixed legacy and NBN commercial works, Telstra’s CEO Andy Penn was optimistic about its future and reiterated that it will provide Telstra with optionality in the post-NBN world where NBN becomes a private entity. We note that Telstra has also said in the past that there is potential for InfraCo to increase tower sharing across its 8,000 sites with vacancy rates at about 20% indicating sufficient room for growth. This is in-line with Venture Insights’ view that telcos could relook at network sharing models as they face increased network spend and yet to be defined incremental revenues opportunities from 5G.[3]

[1] Australian 5G update: Telstra and Optus build continues, VHA entry to influence price?, Venture Insights, 2020

[2] Telstra FY19 Investor Day – InfraCo, Enterprise and 5G to remain in focus, Venture Insights, 2019

Comments